The advancement in digital technology has led to a spurt in digital payment platforms. There are many apps that act as a Digital Mobile wallet and can help you conveniently pay your bills, recharges, shopping, online booking such as movie or bus tickets etc. Besides Oxigen Wallet App there are some other popular wallet apps like Paytm mobile wallet and Mobikwik mobile wallet. But these apps work more than just a wallet. What happens if you want to pay someone electronically who doesn’t have a bank account? Moreover, even if someone does have a bank account, still it takes 30 minutes to 24 hours (depending on bank’s system) to add and pay the beneficiary.

Download the Oxygen Wallet apk for Mobile Payments

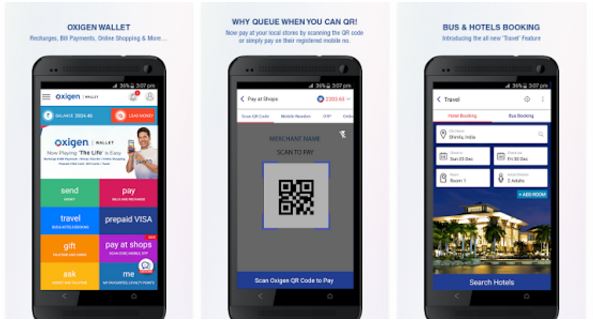

In these situations, the wallet apps prove very handy and Oxigen Mobile Wallet App is one of them. Oxigen Wallet App is in India since 2004 and can be used for mobile/DTH /data card recharges, bill payments, instant money transfers, online shopping, creating and gifting gift cards or E-prepaid cards. Oxigen Wallet App provides the same set of services from both mobile phones and desktops. It is available on Google Play, Apple App store, and Windows store.

Also See: Bhim App: How to Install Bharat Interface for Money Wallet

How to Install and Setup the Oxygen Wallet app

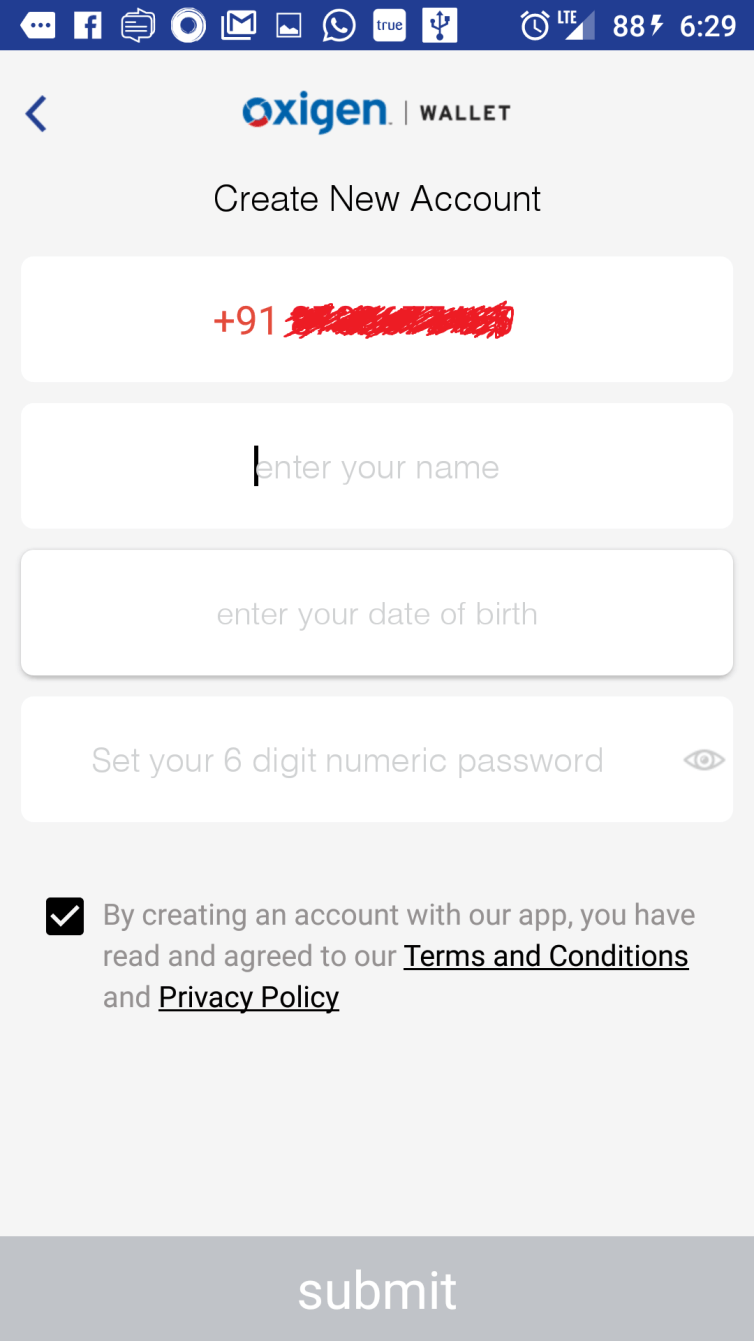

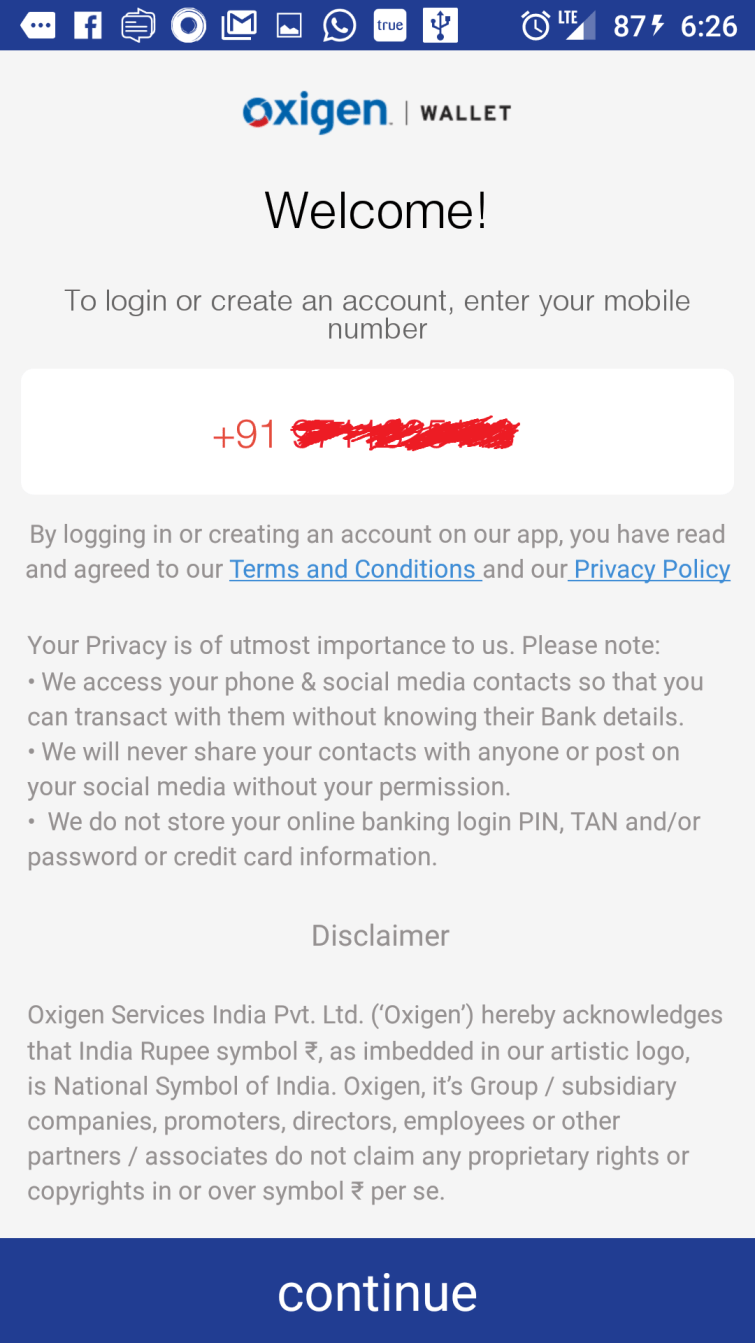

You can sign up for Oxigen Wallet App in a three-step process.

- First, enter your mobile number, name, DOB and six-digit security key.

- A one-time code is generated for verification.

- Then, add your email id and postal code (however, this is optional).

Note: Sometimes we struggled with installing Oxigen Wallet app as it kept failing to respond on various devices including Nexus 4 with Android 7 and Oneplus 2 with Android 6. This is strange and should not have been the case.

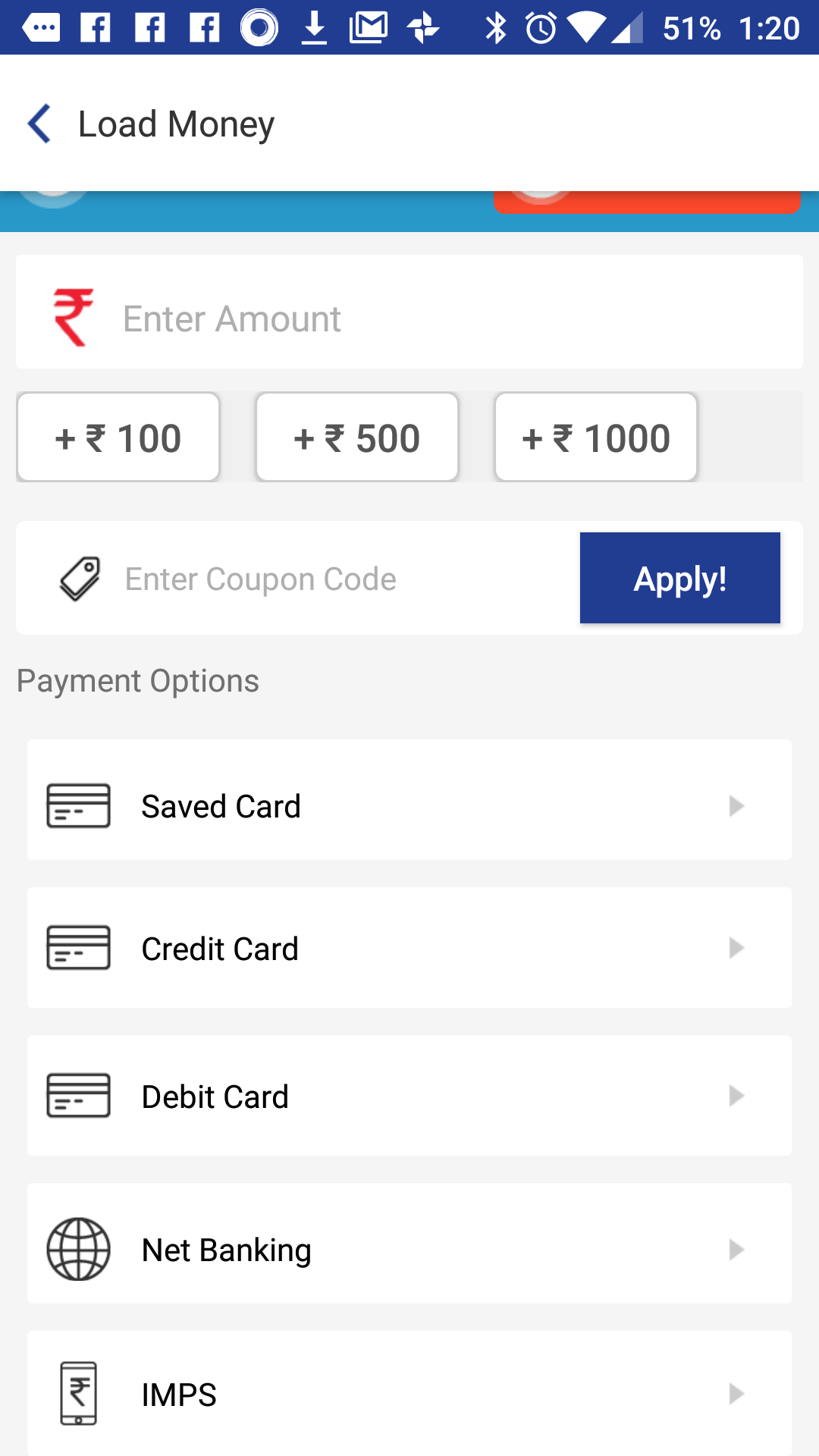

How To Add Money To Your Oxigen Wallet App

After successfully registering, you can load money into your wallet by using any given payment method to add money into the wallet:

- Debit card

- Credit card

- Net banking

- ATM

- IMPS

Note: Net Banking as a mode of the transaction has been disabled at present. But this could be a temporary glitch.

How To Transfer Money From Oxigen wallet App Account

The money can be sent from your wallet to other accounts by using the following methods:

1. By Using Mobile Number

This is a method used to send money from your Oxigen Wallet to some other person’s Oxigen Wallet by using a registered mobile no linked to the wallet.

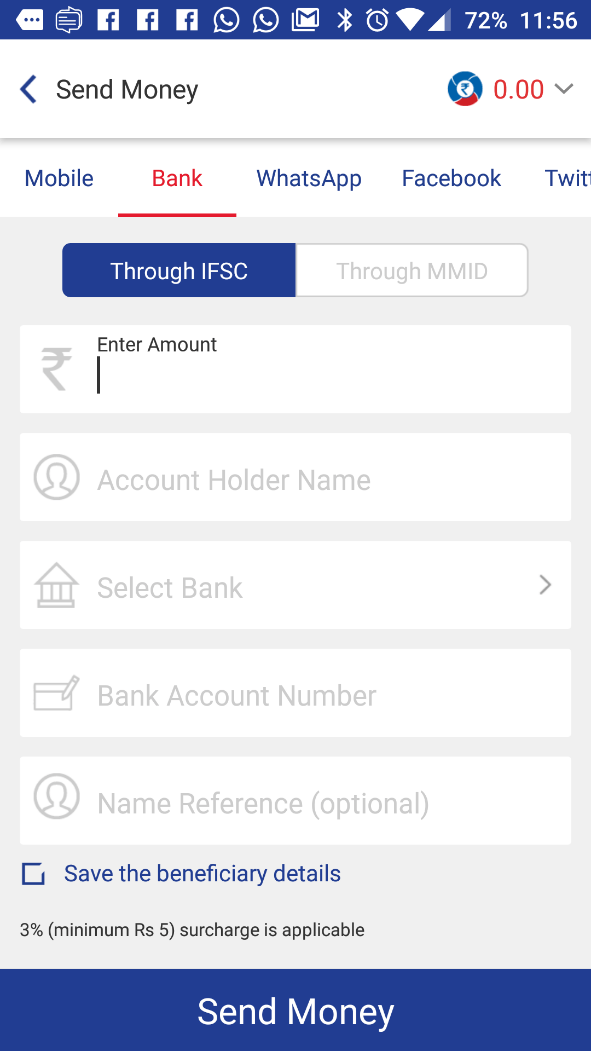

2. Bank Transfer

This method comes handy when you want to deposit money from Oxigen Wallet to the bank account. It supports two methods viz., IMPS and MMID. The charges it takes to transfer the money from wallet to bank is Rs.5/- or 3% of amount whichever is higher for both Non-KYC and KYC accounts. The nonKYC account can deposit Rs 10,000/- and KYC verified users can deposit Rs 100,000/-. The Oxigen Wallet’s charges are higher than the PayTm charges i.e. 1%.

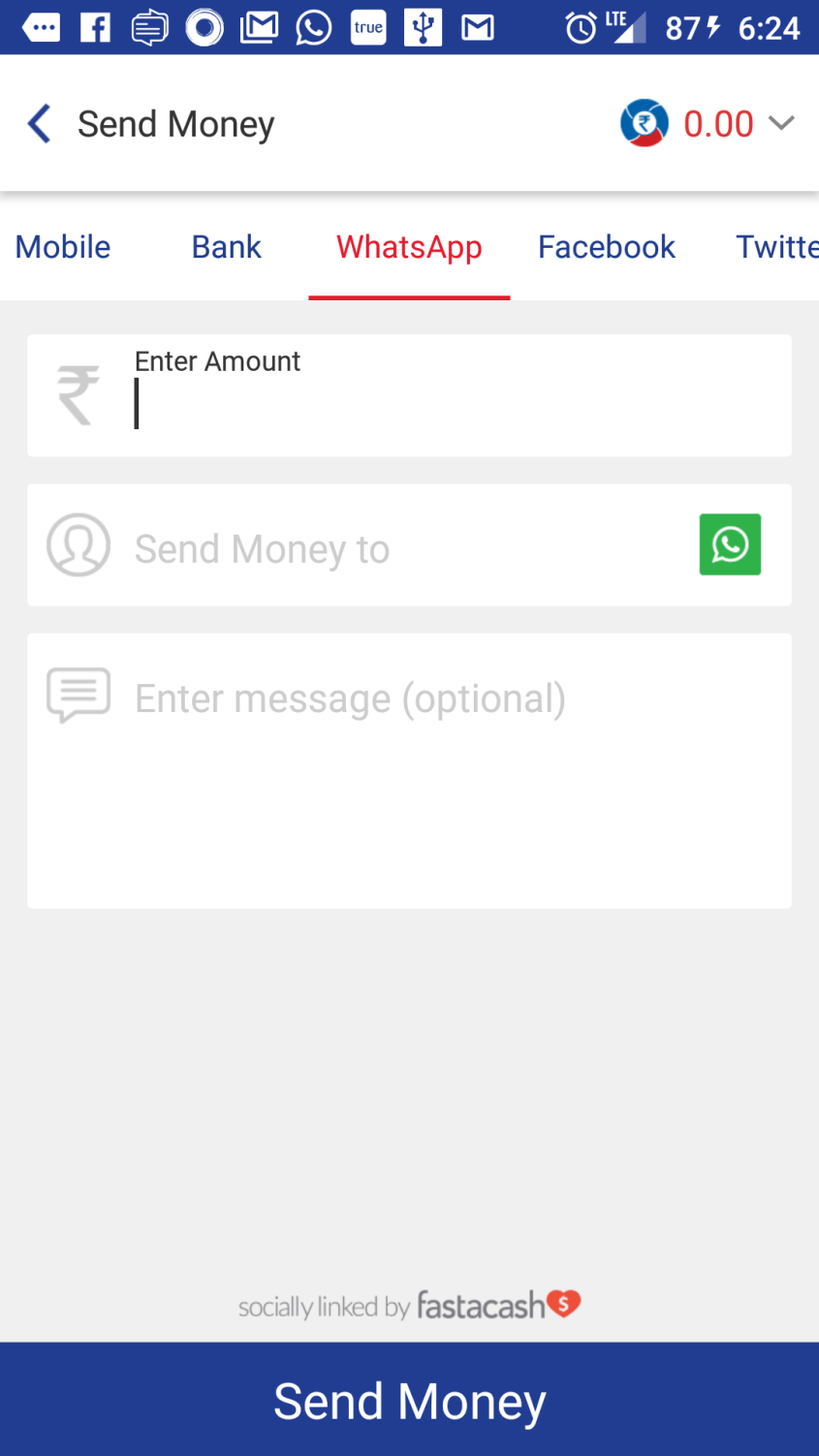

3. By Using Social Medi Account

Users can also use the social media services like WhatsApp, Facebook, and Twitter to send money. The social media transaction is handled by third party integrated service Fastcash.

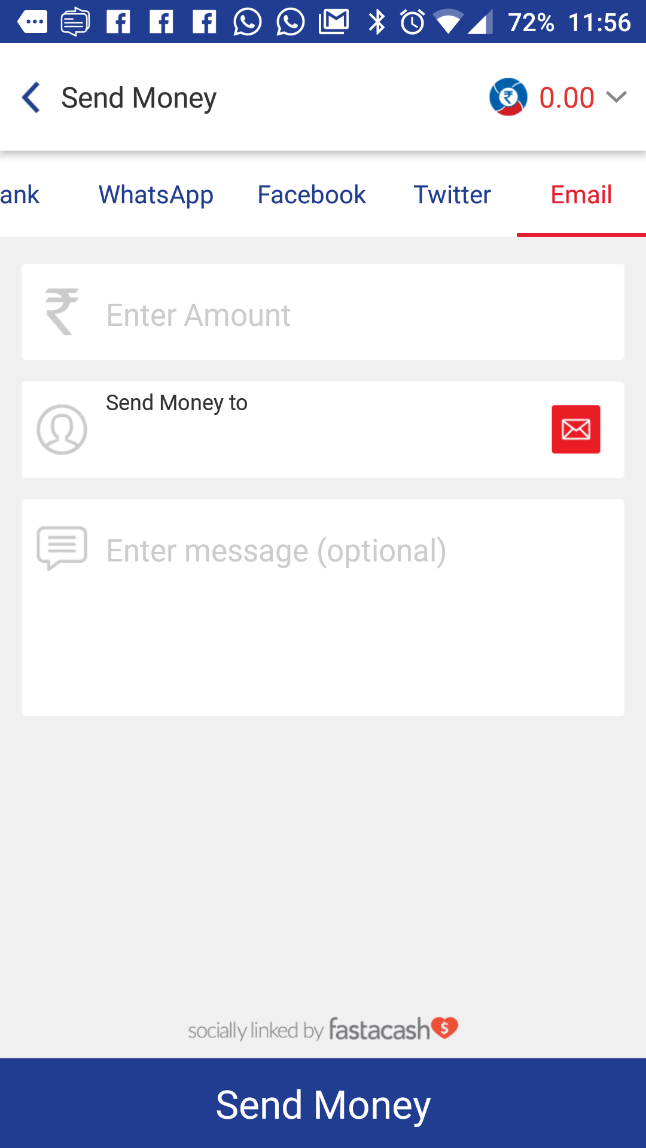

4. Through Email Address

The last option is an Email address. You have to verify your email ID with the wallet and then you can send money to some other’s email verified wallet.

All these options are easy to use but as compared to Paytm, Oxigen has missed some features. For example, there is no option such as scanning QR code to transfer money with the tap of just one button.

Also See: Mobikwik Wallet App Review: A Digital Wallet For Online Recharge

Oxygen Wallet limit and charges

| S.no | Limit and Charges | Wallet Type | |

| Non-KYC Wallet | KYC Verified Wallet | ||

| Rs 10,000/- Wallet | Rs 100,000/- Wallet | ||

| 1 | Maximum Balance limit | Rs. 10,000 /- | Rs 100,000/- |

| Money Transfer limits | |||

| Single Transaction Limit | Rs. 5,000 /- | Rs. 5,000 /- | |

| Daily Transaction Limit | Rs. 10,000 /- | Rs. 10,000 /- | |

| Monthly limit | Rs. 10,000 /- | Rs. 10,000 /- | |

| 3 | Transaction limits | ||

| Single Transaction Limits | |||

| Recharge : Mobile /Data Card | Rs. 2500/- | Rs. 2500/- | |

| DTH Recharge | Rs. 10,000/- | Rs. 10,000/- | |

| Bill payment: Mobile/DTH/Data card | Rs. 5000/- | Rs. 5000/- | |

| Electricity Bill payment | Rs. 10,000/- | Rs. 10,000/- | |

| Daily Transaction Limit | Rs. 10,000 /- | Rs. 10,000 /- | |

| Monthly limit | Rs 10,000 /- | Rs 100,000/- | |

| 4 | Cash Load in Oxigen Wallet: | ||

| Using Credit card/Debit card/Netbanking/IMPS | Free | Free | |

| At Retailer | Rs. 25 + Convenience fee as applicable at specific retailer | Rs. 50 + Convenience fee as applicable at specific retailer | |

| 5 | Subsequent cash loading | ||

| Using IMPS | Free | Free | |

| At Retailer | Convenience fee as applicable at specific retailer | Convenience fee as applicable at specific retailer | |

| 6 | Oxigen Wallet Money Transfer Charges | ||

| Wallet to Wallet ( W2W) | Free | Free | |

| Wallet to Bank Account ( W2A) | Rs.5/- or 3% of transaction amount whichever is higher | Rs.5/- or 3% of transaction amount whichever is higher | |

| Wallet to Non-Wallet | Free | Free | |

| 7 | Mobile Recharge/DTH Recharge/Data Card Recharge | ||

| Using Oxigen Wallet | Free | Free | |

| 8 | Bill Payment | ||

| Using Oxigen Wallet | Free | Free | |

| 9 | Online Payment using Oxigen Wallet | Free | Free |

| 10 | Miscellaneous Products( Vouchers and other Value Added Services) | Free | Free |

| 11 | Online Payment using Oxigen Wallet | Free | Free |

Note: The above-given limit and charges are taken from Oxigen Wallet official website and these charges are liable to change from time to time as per their terms and conditions.

What Other things Oxigen Wallet offers?

Virtual wallet: Prepaid Card

The virtual prepaid card is a rechargeable Visa or Mastercard and the Oxigen Wallet App is allowing you to create a virtual prepaid card directly from the app. This feature of Oxigen is still in Beta stage. The benefit of the virtual card is that you can completely control the card rather than banks controlling it. The flexibility provided by these cards is great. You can use them for online shopping, spending funds when abroad, buying office supplies etc. You can limit the payment and funds of virtual card and it can be created on the spot while paying for something. So, virtual card is a great option for those who want to do their online spending from their credit or debit card.

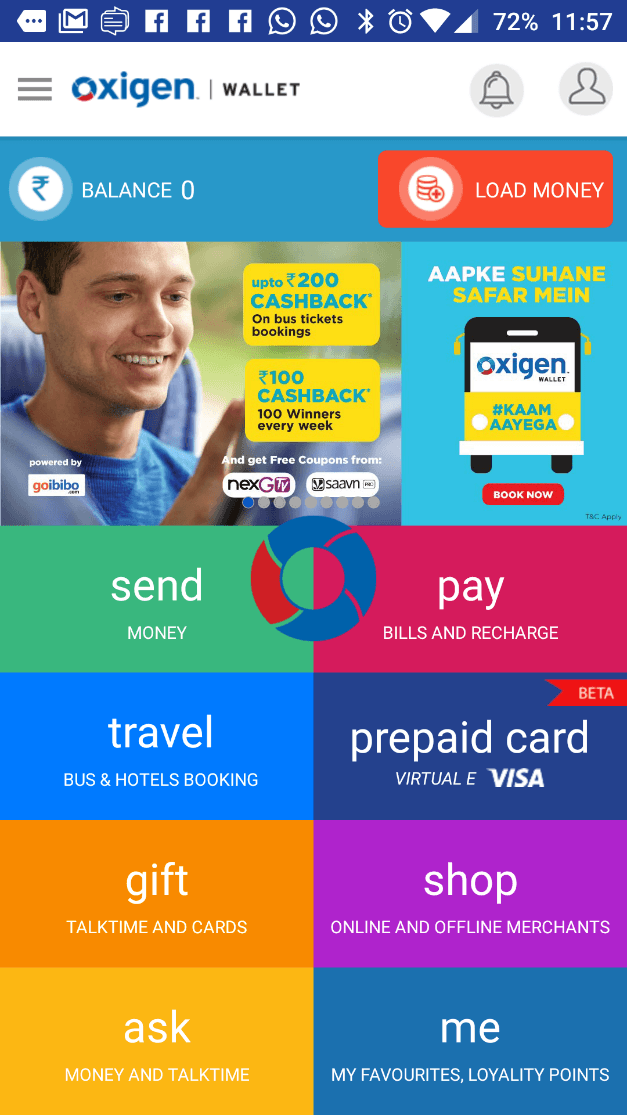

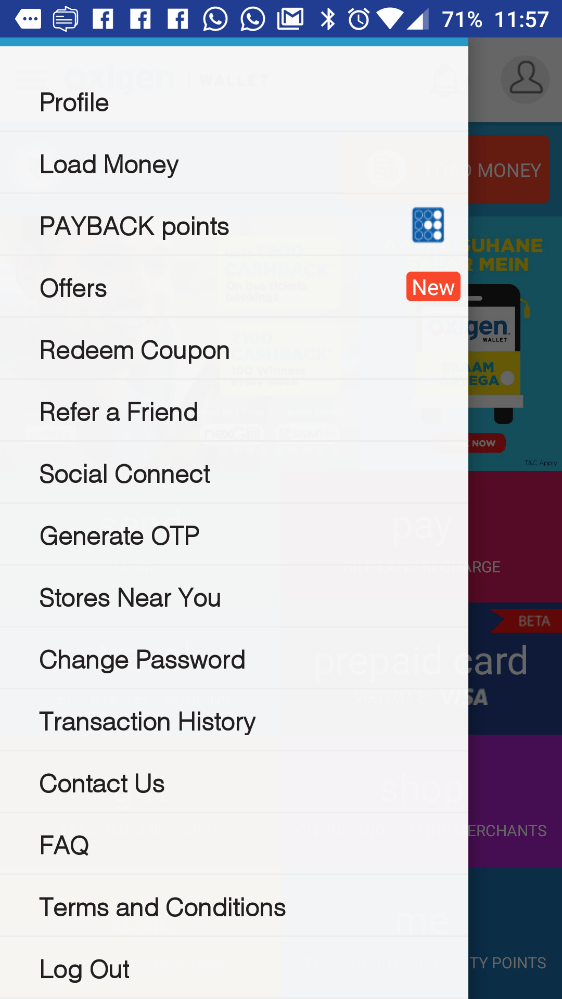

Oxigen Wallet user interface and performance

Let’s now evaluate the app interface. If you are using the Oxigen Wallet App by your smartphone, then the app’s interface should be intuitive enough and easy to navigate. The sign-up process is easy; we didn’t find any difficulty in it. The first screen that opens in the app gives you a complete idea about the functions of this app.

The top side of the app shows how much money we have in the app, while the lower area has different options such as Send, Pay, Travel, Prepaid card, Gift, shop m Ask, and me. The Pay option gives you all options to make recharge and bills payments. The one thing we missed is there is no way to check different telecom recharge packs, which is available in the PaYtm.

If we talk about the performance, then the Oxigen Wallet App is not enough optimized as compared to Paytm. Sometimes we have to click two or three times to open some options. We have used Oneplus 2 &3, Nexus phone to test use this app.

Overall the app interface and performance is good, but the transaction charges are something that bothers us as the Paytm which is also a popular wallet app is charging only 1%. Also, the storage value of the Non-KYC account in PayTm is Rs 20,000/-. However, the Oxigen Wallet is effective and proves very handy to handle your daily recharge and bill payments.

Also See: How to Use WhatsApp on Desktop Computer Using Chrome Browser

Oxigen Wallet App Pros: Interface is simple, single solution to pay all bills and recharges, money transferability to anywhere.

Oxigen Wallet App Cons:

Apps optimization is not good, Can’t give an option to see various telecom recharge packages like PayTm app, charging 3% on per bank transaction which great than PayTm 1%.

Related Posts

Oxigen Expense Management Solutions for enterprises and SMBs- All you need to know about

3 fintech companies plugging the gap in financial inclusion (India)

How To Install and Use Oxigen Wallet App: A Mobile Wallet